Phantom investment meets the ghostbusters

Worries about 'phantom investment' have called into question the reliability of FDI data as an indicator of real international production. Unctad's James Zhan argues that better understanding of the limitations of FDI statistics, together with improvements in the quality of the data and advancements in the available analytical toolkit, should ease fears.

A recent editorial in the Financial Times questions the usefulness of foreign direct investment as an indicator of real international production and calls for an “exorcism of phantom investment”. It has caused a stir among regular users of FDI data. They can relax – the ghostbusters have arrived.

The limitations

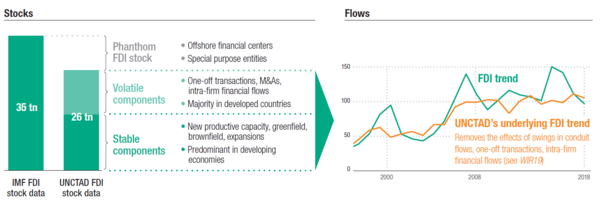

It is true, FDI statistics contain a lot of noise. International organisations and academic researchers have long been aware of the limitations of FDI data. A key defect is that they are distorted by indirect flows through offshore financial centres (OFCs). Conduit flows weaken the link between FDI and real international production. They also generate substantial double-counting in FDI statistics. Other common criticisms include the volatility caused by one-off transactions and intra-firm financial flows, further stretching the link with real investment in productive assets.

But it is possible to strip out much of the noise. Helpfully, conduit FDI affects only a limited number of economies, mainly OFCs and jurisdictions offering so-called special purpose entities (SPEs). For most countries, and especially developing countries, FDI correlates well with the real activities of multinationals. It is thus possible to strip out much of the analytical noise caused by conduit flows by removing OFCs and SPEs from aggregate FDI statistics, as the World Investment Report has done for many years. The value of the cleansed FDI data will further increase as a growing number of countries start reporting separate statistics for SPEs.

That solution does not solve the problem of identifying the real origin of investments coming in from OFCs. But there are ways to look through conduit jurisdictions to unveil real bilateral investment links based on ultimate ownership. UNCTAD has published a dataset that provides FDI positions by ultimate counterparts for more than 100 recipient countries.

Underlying trend

Finally, in order to capture the real productive component of FDI, UNCTAD also started (in the World Investment Report 2019) to complement the standard FDI trend with an underlying trend. The underlying trend removes not only conduit flows, but also the effects of large swings caused by one-off transactions (such as crossborder M&As) and intra-firm financial flows. The impact on FDI flows of repatriations of large stocks of retained earnings by US multinationals following the 2017 tax reforms, for example, is neutralised in the underlying trend.

More good news: FDI data is at its best where it is most needed.The main criticisms of FDI statistics concern almost exclusively developed economies and OFCs. There is no reason why FDI should be routed to or through low-income countries other than for genuine productive purposes. This is a crucial point because developing countries are the main subject of analysis looking at the impact of FDI and the main users of the data for formulating industrial development policies. They are also the most dependent on FDI data because of the paucity of reliable alternative information on investment.

Clear synergies

There are clear synergies between FDI and greenfield project data. We cannot describe the complexity of the global economy with just one tool. To paint an accurate picture of international production, FDI data must be complemented with investment project data (such as announced greenfield projects from the Financial Times-owned fDi Markets), but also firm-level, survey-level and value-added trade data. One dataset can show the trees, you need them all to reveal the forest.

Despite its limitations, FDI remains a useful indicator of international production. A better understanding of the limitations of FDI statistics, together with improvements in the quality of the data and advancements in the available analytical toolkit, will safeguard its insightfulness.

James Zhan is senior director, investment and enterprise at Unctad.

Global greenfield investment trends

Crossborder investment monitor

|

|

fDi Markets is the only online database tracking crossborder greenfield investment covering all sectors and countries worldwide. It provides real-time monitoring of investment projects, capital investment and job creation with powerful tools to track and profile companies investing overseas.

Corporate location benchmarking tool

fDi Benchmark is the only online tool to benchmark the competitiveness of countries and cities in over 50 sectors. Its comprehensive location data series covers the main cost and quality competitiveness indicators for over 300 locations around the world.

Research report

fDi Intelligence provides customised reports and data research which deliver vital business intelligence to corporations, investment promotion agencies, economic development organisations, consulting firms and research institutions.

Find out more.