UK set for worst year of FDI since 2010

Foreign investment into the UK between January to October 2018, hit its lowest since 2010 in terms of project number, according to fDi Markets

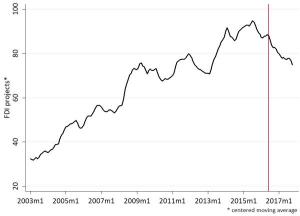

The number of foreign investment projects into the UK in 2018 is set to hit its lowest in eight years, following the worst Q1 to Q3 FDI figures since 2010, according to fDi Markets, a Financial Times database that has monitored cross border investment since 2003.

Figures have dropped consistently since 2015’s January to October period, going from 883 FDI projects to 609 this year.

“For the UK, [2015 to 2018 has] been the longest continuous decline in FDI since records began, with the 10% reduction in the number of projects and £1.5bn reduction in the value of capital investment between 2016 and 2017,” found research from the UKTPO, based on fDi Markets data.

The UKTPO contends that overseas investment to the UK may be some 19% lower because of the vote to leave the EU.

The third quarter of 2018 marks the 10th consecutive quarter of declining business confidence, the most prolonged period of pessimism since the 2008 global financial crisis, according to a recent CBI/PwC Financial Services Survey of 100 firms.

“For the sector to continue to be one of the UK’s most attractive economic assets, it is fundamental that a Withdrawal Agreement with the EU is agreed. This will provide temporary but essential relief for financial services firms of all sizes. Then attention can turn to the vital task of finalising our future economic relationship with the EU, in which services need to play a pivotal part,” said Rain Newton Smith, CBI chief economist.

Global greenfield investment trends

Crossborder investment monitor

|

|

fDi Markets is the only online database tracking crossborder greenfield investment covering all sectors and countries worldwide. It provides real-time monitoring of investment projects, capital investment and job creation with powerful tools to track and profile companies investing overseas.

Corporate location benchmarking tool

fDi Benchmark is the only online tool to benchmark the competitiveness of countries and cities in over 50 sectors. Its comprehensive location data series covers the main cost and quality competitiveness indicators for over 300 locations around the world.

Research report

fDi Intelligence provides customised reports and data research which deliver vital business intelligence to corporations, investment promotion agencies, economic development organisations, consulting firms and research institutions.

Find out more.