fDi Investors of the Year 2016

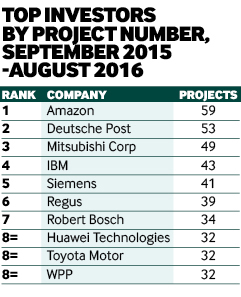

Logistics powerhouses Amazon and Deutsche Post have ranked as fDi Magazine’s top investors for 2016, followed by Japan-based Mitsubishi Corporation. Cathy Mullan reports.

US-based logistics and online retail company Amazon was the top investor globally between September 2015 and August 2016, according to data from greenfield investment monitor fDi Markets. Amazon made 59 investments in the 12-month period, nearly 60% of which was in logistics, distribution and transportation.

Download a PDF of the report here:

Most of the projects (37%) were created in the UK, including a warehouse in Wythenshawe in December 2015, which created 1500 jobs. The company was also named top investor for western Europe.

Germany-based Deutsche Post ranked in second place, investing in 53 projects during the same time period. Western Europe was the main destination market for Deutsche Post, followed by Asia-Pacific, emerging Europe and North America, which each received six investments.

The company’s subsidiary, DHL Supply Chain, announced a $171m investment to double its presence in Mexico between 2016 and 2020 as part of a development strategy announced in 2012, which focused on expanding in line with growth opportunities in the BRIC countries and Mexico.

Mitsubishi’s expansion

Japan-based Mitsubishi Corporation ranked third, investing in 49 projects in the 12-month period. Nearly 38% of the company’s investments were in the industrial machinery, equipment and tools sector, more than 10% in real estate and over 8% in each of automotive OEM, chemicals, and food and tobacco sectors. The company was also named Asia-Pacific’s top investor for 2016.

North America’s top investor was Japan-based automotive company Toyota Motor. In April 2016, the company announced investments in two R&D centres in the US – one in Ann Arbor, Michigan, and a second in Plano, Texas. Investment in R&D operations accounted for more than 60% of all Toyota Motor’s FDI in North America in the 12-month period.

Latin America has been a focus for Spain-based Telefonica Group, a telecommunications specialist that has been named Latin America’s top investor for 2016. In May the group announced development plans in several countries, including an expansion of its 3G and 4G network in Argentina at a cost of nearly $645m.

A 5000-square-metre tier-three data centre was opened in Chile and the company’s wireless network was expanded in Mexico, as part of the company’s strategy to enter new markets and connect rural populations.

Germany-based Daimler has been named as emerging Europe’s Investor of the Year for 2016. The company invested in eight projects in the region between September 2015 and August 2016, including a $1.12bn investment in a manufacturing plant in Kecskemét, Hungary, which will provide 2500 jobs when the facility is completed in 2020. Manufacturing plants were also announced in Jawor in Poland, Aksaray in Turkey and Cugir in Romania.

Huawei tops Middle East

Telecom giant Huawei Technologies has been named as the top investor for the Middle East region, investing in seven projects. The company announced plans to establish an innovation laboratory in Ar Rayyan, Qatar in February 2016, and in May 2016 revealed plans to establish a research centre in Dubai.

The company also plans to establish an ICT competency centre in Saudi Arabia, which will have the capacity to train 4500 professionals when it opens in 2019.

Africa’s top investor for 2016 was UK-based banking group Old Mutual, which made nine investments in the region during the time period analysed. The company invested in Namibia and Kenya through its Nedbank and Faulu Microfinance Bank subsidiaries.

Methodology

For this ranking, the fDi Intelligence division of the Financial Times reviewed FDI data globally between September 2015 and August 2016. The data was recorded from fDi Markets, the online FDI tracking tool from fDi Intelligence. This data was then analysed and a ranking was compiled, ranking parent companies by the number of investment projects in the time period. Regional awards were given for the top investors within a region in the time period.

Global greenfield investment trends

Crossborder investment monitor

|

|

fDi Markets is the only online database tracking crossborder greenfield investment covering all sectors and countries worldwide. It provides real-time monitoring of investment projects, capital investment and job creation with powerful tools to track and profile companies investing overseas.

Corporate location benchmarking tool

fDi Benchmark is the only online tool to benchmark the competitiveness of countries and cities in over 50 sectors. Its comprehensive location data series covers the main cost and quality competitiveness indicators for over 300 locations around the world.

Research report

fDi Intelligence provides customised reports and data research which deliver vital business intelligence to corporations, investment promotion agencies, economic development organisations, consulting firms and research institutions.

Find out more.